America’s energy security risk in 2016 was at its lowest point in two decades, according to the 2017 edition of the Global Energy Institute’s Index of U.S. Energy Security Risk.

This latest edition of the Index, the eighth in the series, incorporates the most recent historical data and updated forecasts from the U.S. Energy Information Administration and other government and private energy-related datasets. The Index includes 37 different measures of energy security risk—everything from imports to prices to efficiency—and covers the period from 1970 to 2040.

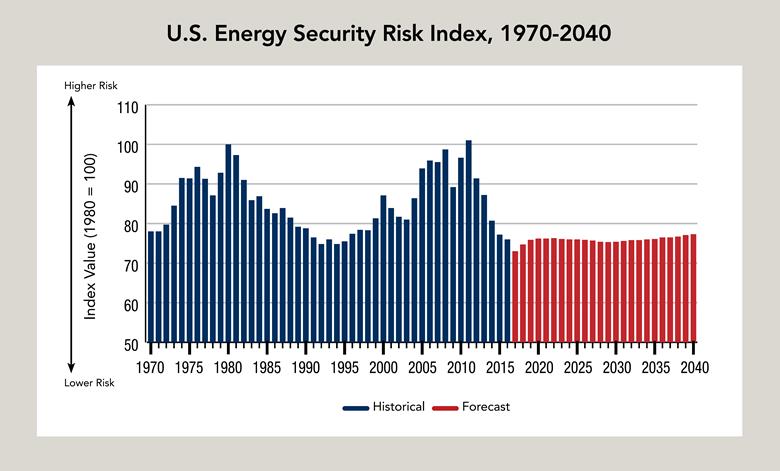

When analyzing the results, keep in mind that a low Index score is better than a high Index score. To give you an idea of the range, Index scores around 100 are very bad (high risk) while those in the 70s are very good (low risk).

In 2016—the most recent year available—the total U.S. energy security risk dropped 1.2 points, to 76.0, the lowest level since 1995. This is the fifth consecutive year that the overall U.S. risk score has declined. During these five years since 2011, the total risk fell a remarkable 25 points from its all-time high of 101. Going back to 1970, there has been no five-year period during which the total U.S. risk score changed as rapidly, either up or down, not even during the oil crises of the 1970s.

Preliminary numbers suggest that 2017 will set a record for the lowest risk score in our record. Further, based on the most recent forecast from the Energy Information Administration, it is expected that U.S. Index risk scores will stay below 78 points through 2040. If this forecast holds, this would represent an unprecedented period—nearly 25 years—of energy security risk scores below 80.

It won’t surprise those who have been following the Index that the single biggest factor in the U.S. improvement has been the widespread use of hydraulic fracturing, horizontal drilling, and advanced seismic imaging technologies to unlock vast quantities of oil and natural gas in shale formations. Because of the shale revolution, the United States has enjoyed greater energy self-sufficiency—and thus lower levels of oil and gas imports—lower costs and expenditures, and reduced emissions, all of which have contributed greatly to lowering our energy security risks.

The ability of U.S. oil and gas producers to adjust rapidly to new market conditions and exceed expectations continues to astound, even in the face of recent attempts by OPEC to drive U.S. frackers out of business. It has been said that in world crude oil markets, Saudi Arabia’s excess production capacity made it the global “price maker” while the United States was a “price taker.” No more. With its ability to respond rapidly to price increases and ramp up production almost instantly from large and growing inventories of untapped wells, America is now effectively the world’s “price breaker,” able to restrain crude oil prices from spiking.

The one negative this year was continued high oil price volatility risk. Sharp movements in prices, either up or down, can create unstable market conditions that increase energy security risks. In 2015 and 2016, high volatility resulted from a rapid drop in the price of crude oil from well more than $100 per barrel to under $50 per barrel. While prices are expected to recover in the future, the ability of U.S. producers to respond almost instantaneously with higher output in response to higher prices means that upside volatility is likely to become less of a factor in the short to medium term.

Underlying long-term trends towards more efficient energy usage throughout all sectors of the economy also have contributed to the decline in overall risk we have seen recently. It take 60% less energy to produce a dollar of economic activity than it did in 1970 while the average miles per gallon of our vehicle fleet has improved 54%.

A special feature in this year’s Index of U.S. Energy Security Risk is a look at trends in security of power generating capacity margins and transmission mileage, two measures that are central to grid reliability a hot topic at the moment. Our GEI President and CEO Karen Harbert also uses her Foreword to discuss some risks that we can’t capture in our Index but that nonetheless capture the attention of the energy industry and policymakers alike.

The 2017 U.S. Index and its companion volume, the International Energy Security Risk Index, are available on our website at https://www.globalenergyinstitute.org/energy-security-risk-index.