Since the early 1970s, Democratic and Republican presidential administrations and other policymakers have made energy security a priority. Yet, we have lacked a tool to regularly measure our nation's progress and thus assess the impact of policy decisions on America's energy security. Indeed, energy is still recognized today as among the top challenges to our Nation's future prosperity, national security, and way of life.

The Index of U.S. Energy Security Risk: Assessing America's Vulnerabilities in a Global Energy Market is an annual energy risk indicator, which uses quantifiable data, historical trend information, and government projections to identify the policies and other factors that contribute positively or negatively to U.S. energy security. The Index provides a look at energy security retrospectively from 1970 to 2017 and prospectively from 2018-2040. From this data, policymakers and energy professionals can use the Index to track shifts in U.S. energy security over time and assess potential impacts of new policies.

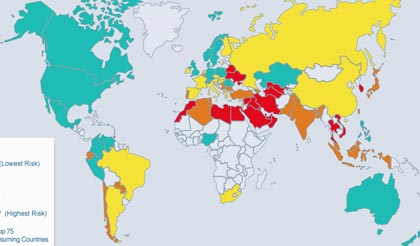

In 2012, the Energy Institute launched the International Index of Energy Security Risk, a new tool designed to facilitate a better understanding of global energy markets. The 2020 International Index applies the same quantitative analysis used in the US Index to rank the top global energy users in 29 metrics.

U.S. Energy Security Risk Index

2020 U.S. Energy Security Risk Index Report

International Energy Security Risk Index